April 15, 2014 - In any successful industry, there will always be plenty of companies out to make their share of the profit. The phone industry is no exception. Our smartphones are our constant companions, and there's a lot of money to be made from them.

While most companies provide tangible benefit in return for our cash, there are always some bad apples that are just there to make a quick buck. Some of these businesses have resorted to a tactic called "cramming", which may already be costing you money.

Now, in order to understand how cramming works, you have to understand how mobile phone billing works. Basically, by default, your mobile account can accept direct billing from third party companies. In the vast majority of cases, this is fine. You agree to buy something like a ringtone or an app, and then the charges are consolidated into your next phone bill. It's convenient for all parties involved.. you don't have to provide billing information to an extra company, your carrier gets a cut of the money(up to a third of the total bill), and the seller has a lot less overheard to deal with. It's really a winning situation all around.

The unfortunate aspect to mobile billing is that it really works on the honor system. Even though it's illegal, a seller can easily get away with charging your phone account for goods or services that you did not request, and in many cases, that you didn't even receive. This is called cramming.

..but you can just get these charges wiped from your account, right? Not necesarrily.

The problem with getting these charges removed from your account is multi-faceted.

First, the only entity that can actually refund you is the same company that billed you to begin with. Your carrier is a middle man and can only offer you a credit, not an actual refund. This is money out of their pockets, so they will at first insist you contact the biller directly for a refund. Good luck getting a refund from a company that didn't have the right to bill you in the first place!

Second, because you've never explicity agreed to buy something, you may not even realize that the charges have been placed on your account. Because cell phone plans are full of fees that seem to change constantly, you may not notice an extra 5 or 10 bucks a month, and that's exactly what the crammers hope for. By the time you report these charges to the carrier, it's harder for them to believe that you didn't know about them earlier. At this point, you may be lucky to get a credit to cover 1 month worth of charges, and it might take a serious fight to get back all of what you were charged.

Second, because you've never explicity agreed to buy something, you may not even realize that the charges have been placed on your account. Because cell phone plans are full of fees that seem to change constantly, you may not notice an extra 5 or 10 bucks a month, and that's exactly what the crammers hope for. By the time you report these charges to the carrier, it's harder for them to believe that you didn't know about them earlier. At this point, you may be lucky to get a credit to cover 1 month worth of charges, and it might take a serious fight to get back all of what you were charged.

Finally, it's your word against theirs. The companies participating in this scheme are business partners to the carriers, and all parties (except for you) are profitting from the practice. Because your carrier is only honoring their billing agreements, they have some amount of deniability in the matter, and every successful charge is money in their pockets.

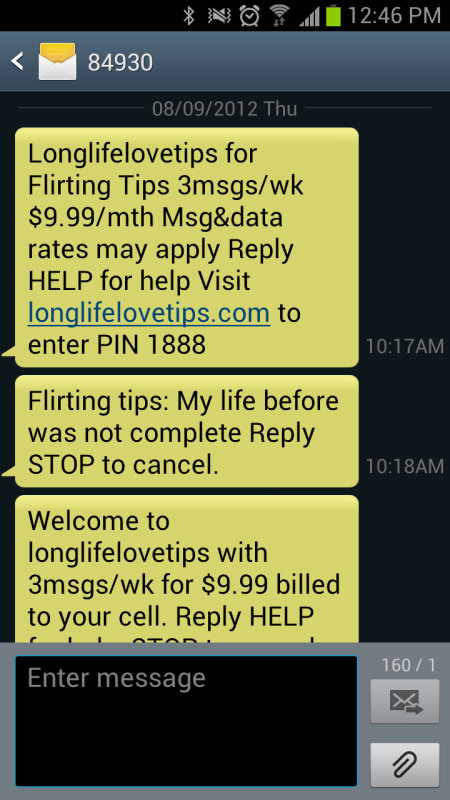

When I was personally crammed last year, this was the roadblock I ran into while arguing for my money back. My carrier insisted that I did sign up for the service, despite providing them with screenshots of text messages that show my "agreement" to sign up was not responding to a solicitation via text message within a couple minutes. Obviously you cannot agree to a contract without some form of response, and even so it took over 2 months for my account to be credited and the ongoing charges cancelled. I also had to agree to disable carrier billing and short-code SMS access on my account. Because of this, I can no longer use useful SMS services, enter contests, or take advantage of charging app purchases to my phone account.

The scheme may be on it's way out completely, though, after one of the largest crammers in the US, Wise Media, settled with the Federal Trade Commission in November 2013 in response to charges of cramming consumers for a total loss of over $10,000,000. In the settlement, Wise Media and it's CEO agreed to pay fines of over $10,000,000 as well as to stop the practice of unauthorized billing of goods and services. The remaining assets of Wise Media were also forfeited due to their inability to pay the entire fine.

With Wise Media's downfall as a solid example and warning, we expect (and hope) that others will take the hint and stop the practice.

Nevertheless, you should always be sure to check your phone bill carefully to make sure you have not been targeted by any remaining crammers.